The market for naval surveillance radars to equip large surface combatants could be worth in excess of $2.6 billion over the next 15 years.

Naval surveillance radars routinely equip large warships like aircraft carriers, cruisers, frigates, destroyers and corvettes. These sensors play a vital role providing combat situational awareness by detecting, identifying and tracking air and surface targets with a high level of precision.

Regarding the air domain these radars will typically detect air targets at ranges of several hundred nautical miles. They may also detect air targets at altitudes of several hundred thousand feet. A demonstration of Thales’ Smart-L L-band (1.215 gigahertz/GHz to 1.4GHz) radar witnessed by the author revealed the impressive performance of such systems. It could track satellites in space within the radar’s field-of-view. In 2018, the company said that a Smart-L radar at the company’s facility in Hengelo, eastern Netherlands, tracked a ballistic missile target launched from the Hebrides archipelago. The Hebrides are over 810 nautical miles/nm (1,500 kilometres/km) on the west coast of Scotland. Surface target ranges are typically much lower. This is because a radar transmission follows a line-of-sight trajectory and struggles to bend around the curvature of the Earth for any great distance. A radar positioned 30 metres (98 feet) above the waterline will typically have a surface detection and tracking range of 13.7nm (22km).

Naval surveillance radars play a key role in ship defence detecting incoming anti-ship missiles. They may also be equipped with radio frequency links to Surface-to-Air Missiles (SAMs). The radar will send course correction commands to the missile as it continuous to track the target, eventually bringing the two together. In short, a naval surveillance radar is equipment that a large surface combatant cannot be without.

The market for naval surveillance radars to equip new combatants over the coming 15 years is significant. Radars will be needed for up to 78 new vessels expected to equip ten nations around the world. The largest market is likely to be the United States where demand could be worth up to $1.9 billion. Demand in Europe will constitute the second largest market globally worth up to $459 million. The Asia-Pacific could be the third largest market worth up to $280.5 million. Finally, Africa is expected to have the smallest market share worth $12.5 million.

This forecast is confined to planned vessel acquisitions where radar contracts are yet to be awarded. Globally, there are many more naval shipbuilding programmes ongoing than mentioned in this report. For example, several initiatives are ongoing in Latin America and the Middle East. However, radar selections in these cases have been made and are thus not relevant to this article. This is also the case for acquisitions in some parts of the Asia-Pacific. Demand in the People’s Republic of China (PRC) and Russia has also been deliberately omitted. Both countries have closed markets where requirements are satisfied by local suppliers. Third party radar suppliers will be prevented from entering these markets due to sanctions and restrictions on military technology exports. This report has taken an average value of $12.7 million for the price of a new naval surveillance radar based upon average pricing for such systems observed by the author over several years. Obviously, some systems will cost much more than this and some may cost less. The idea is to provide an indication of potential average market size as opposed to precise costings.

Africa

Africa is expected to have the lowest demand for new naval surveillance radars over the coming 15 years. Several new warship acquisitions are ongoing around the continent. Nigeria appears to be the only nation with an outstanding unawarded requirement for a new surface combatant. In April 2021 it was reported that the country was keen to buy a new frigate. This could replace the navy’s solitary NNS Aradu ‘Meko-360’ class frigate which is reportedly now unable to perform combat operations. Local reports say the navy is looking to purchase a solitary ship to replace her. This could trigger a corresponding demand for a single naval surveillance radar to equip this new vessel. It is unknown when the ship could be acquired although a possible 2025 acquisition date has been mooted.

Europe

Europe is expected to have a handsome demand for new naval surveillance radars over the next decade and a half. This seems likely to be driven by a handful of nations comprising Italy, France, Greece, the Netherlands, Spain and Turkey. By far the largest undertaking is expected to be the European Patrol Corvette programme. This pan-Continental project was launched in 2019 and under the auspices of the European Union’s (EU’s) Permanent Structured Cooperation (PESCO) initiative. PESCO forms a key part of the EU’s common security and defence policy which helps foster closer military cohesion and cooperation between member states. A key component of this is collaboration on defence technology development and acquisition.

The European Patrol Corvette programme involves five EU nations plus Norway. EU public documents name Italy as the project coordinator with Croatia and Portugal as observers. Construction of the corvettes is expected to commence in 2026, with deliveries occurring four years later. Contracts should be signed one year earlier. Initial purchases of the resulting new corvettes are expected to be made by France, Greece, Italy and Spain with each country purchasing six apiece. No details have appeared in the public domain regarding the radar dimension of this programme. Perhaps a choice of radars maybe offered for the ships with the choice left to each customer? The EU is home to four major naval radar manufacturers in the guise of Hensoldt, Leonardo, Thales and Saab. Will a consortium of several companies be formed to provide a common corvette radar for the new ships? Alternatively, will France and Italy opt for systems built by Thales and Leonardo respectively? On its own, the radar acquisition could be worth up to $306.6 million. This figure does not include radar acquisitions for corvettes purchased by future customers beyond those already mentioned.

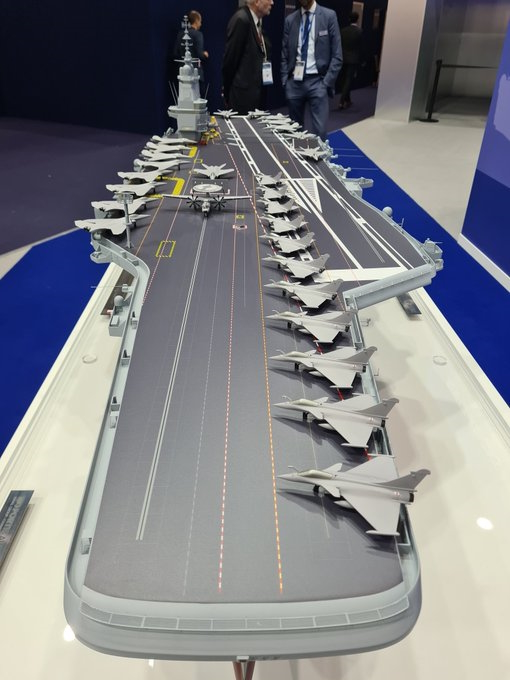

Larger vessels are also in demand in Europe. Both France and Turkey are in the market for aircraft carriers. The Marine National (French Navy) is moving ahead with the Porte-Avions de Nouvelle Génération (PANG). This will replace the current Charles de Gaulle carrier. So far, only a single ship is planned, according to the French government. Estimations state that construction should start in 2025 for a 2038 service entry. No reports have reached the public domain concerning the radar to equip the vessel. Nonetheless, France is home to Thales and it would seem all but certain that the company will be tasked to provide the PANG’s radar.

Likewise, the Türk Deniz Kuvvetleri (Turkish Navy) is planning the procurement of a single aircraft carrier. In 2018 Turkey announced her intention to build a STOBAR (Short Take-Off But Assisted Recovery) design. Construction is expected to start in 2029. Like the French Navy’s PANG programme, this could see the demand for at least one naval surveillance radar to equip the vessel. It is likely this will be sourced domestically. ASELSAN has proven expertise in radar technology and it would be surprising if the company was not tasked to develop the new radar for this ship. The company is also likely to benefit from the Turkish Navy’s ‘TF-2000’ class destroyer programme. This initiative calls for the procurement of eight new anti-air warfare destroyers according to reports. These same reports state that deliveries could begin in 2027. Once again, it would be surprising if ASELSAN was not awarded the contract to develop the radars. This programme could be worth up to $102 million to the company.

Like Turkey, the Koninklijke Marine (Royal Netherlands Navy) is in the market for new frigates to replace its existing ‘De Zeven Provinciën’ class ships. A minimum of two new vessels could be acquired to this effect between 2025 and 2029 according to reports. The radar requirement for these two ships could be worth up to $25.5 million. However, this demand is likely to be satisfied domestically. As noted above the Netherlands is home to part of Thales’ naval surveillance radar business. It seems likely that the company’s facilities in Hengelo will be used for the development and production of this new equipment.

Asia-Pacific

Much like Europe, the Asia-Pacific is a nuanced market for naval surveillance radars. Future demand is dominated by India and Taiwan. Between them, they have an appetite for 27 new vessels with the biggest requirement coming from Taiwan. The country is in the market for new frigates and destroyers, needing four and eight new vessels respectively. In 2022 media reports spoke of the frigate project experiencing problems. The National Chung-Shan Institute of Science and Technology (NCIST) was tasked with developing the frigate radar. This is apparently not going as smoothly as planned potentially retarding the overall development of the vessels. As of April 2022, some lawmakers in Taiwan were urging the company and the navy to resolve this problem as quickly as possible. There are clearly concerns that this could slow the acquisition of the new ships earmarked for delivery by 2030. If NCIST does not succeed in solving these problems there is every chance the government may look abroad to source the new frigates’ radars. On the one hand, this could present opportunities for global radar suppliers. On the other, there is the prospect that the country supplying the radar to the Taiwanese Navy receives an angry reaction from the PRC. Moreover, the United States has traditionally been the premier supplier of materiel to the Taiwanese armed forces. Thus, there is every likelihood that the procurement of any foreign radar for these ships could come from the US.

India joins France and Turkey in planning the acquisition of a new aircraft carrier. The INS Vishal is planned as a replacement for the INS Vikramaditya ‘Kyiv’ class aircraft carrier India acquired in 2004. Once in service the new ship will complement the Indian Navy’s INS Vikrant carrier which commissioned in 2022. At least one naval surveillance radar will be needed for the new ship. The INS Vikramaditya has two such systems. These include Israel Aerospace Industries’ EL/M-2248 MF-STAR S-band (2.3GHz to 2.5GHz/2.7GHz to 3.7GHz) radar and Leonardo’s RAN-4L L-band radars. While it is possible that the INS Vishal will have a foreign-sourced radar, there is a chance that the radar could be procured domestically. A compromise could see the Indian government buying radars from a third party but manufacturing them domestically. The Indian Navy is also acquiring new corvettes under the NGC (Next Generation Corvette) programme. Reports say that seven ships may be purchased. These could have a corresponding demand for the same number of radars, potentially worth up to $89.2 million. The same possibilities apply regarding likely suppliers as applies to India’s aircraft carrier radar acquisition.

Further afield in the Asia-Pacific, the Republic of Singapore Navy (RSN) is expected to purchase up to six new frigates to be delivered by 2030, according to Singapore government documents. There is no indication yet on which company may supply radars for these ships. Traditionally, the RSN has sought naval surveillance radars from third party suppliers. IAI, Terma, Thales and Saab have all supplied naval radars to the RSN over the past 40 years. These companies, and their competitors, stand in good stead to potentially supply new radars for these ships in the coming years.

United States

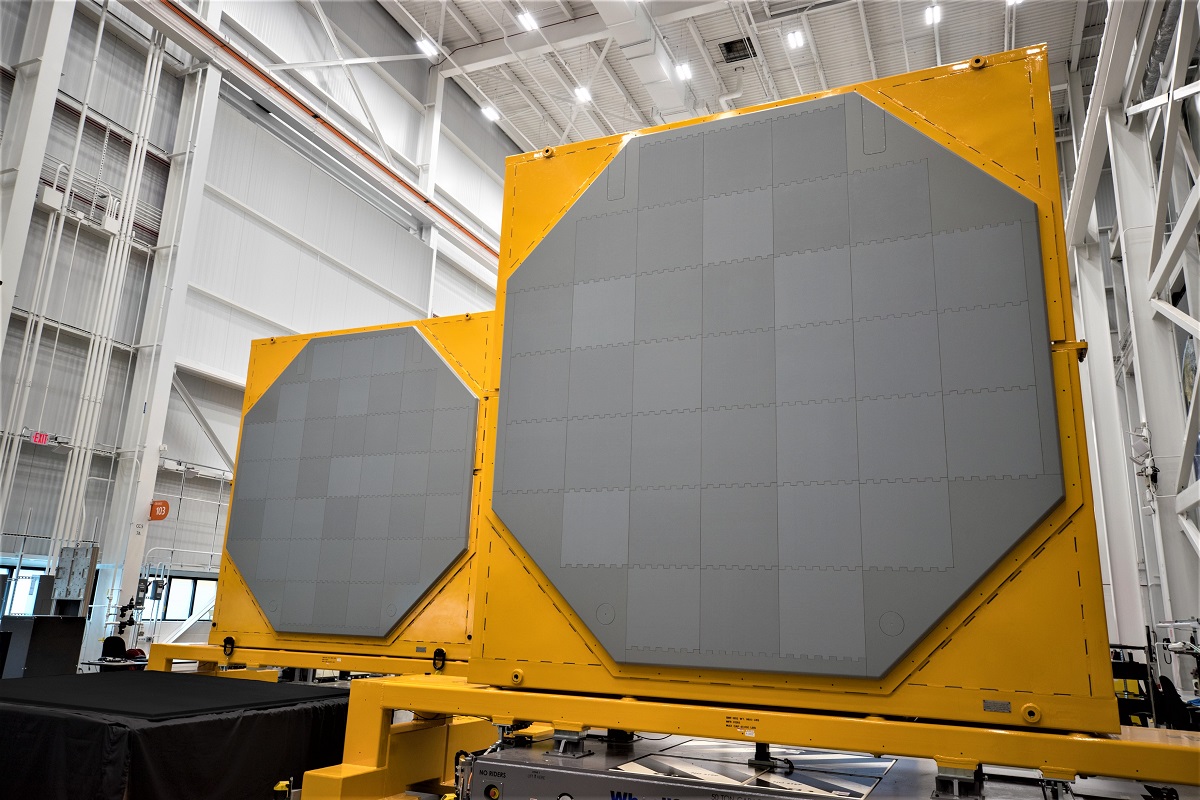

The US market for new naval surveillance radars represents the world’s largest, worth $1.9 billion. The US Navy has a major demand for new radars over the coming 15 years. The DCG(X) Next Generation Guided Missile Destroyer programme will see the procurement of up to eleven new ships. These will replace the fleet’s ‘Ticonderoga’ class cruisers and ‘Arleigh Burke Flight-I/II’ class destroyers. While the size of this procurement is impressive, there are almost no opportunities for non-US radar suppliers. Raytheon’s AN/SPY-6(V)1 S-band radar will be used across the class. This will also be the case for the navy’s FFG(X) future frigate programme. A total of 20 vessels are planned, all of which are likely to be furnished with the AN/SPY-6(V)3 version. The US Navy is not necessarily a ‘closed shop’ for non-US radar suppliers beyond these initiatives. It is instructive that both the ‘Freedom’ and ‘Independence’ classes of littoral combat ship are equipped with non-US radars. The former carries the EADS/Airbus TRS-3D/4D system and the latter Saab’s AN/SPS-77(V)1.

Conclusion

On paper, the prognosis for the naval surveillance radar market looks healthy over the coming 15 years. Worth $2.6 billion, there should be a global demand for at least 78 new systems. That said, radar suppliers around the world may find their opportunities limited. As mentioned above, the US largely remains a closed market in the near term. This looks also to be the case for France, the Netherlands, Italy and Turkey. Nonetheless, opportunities may present themselves in India, Nigeria, Singapore, Spain and Taiwan. Expect contracts for these acquisitions to be keenly pursued.

by Dr. Thomas Withington